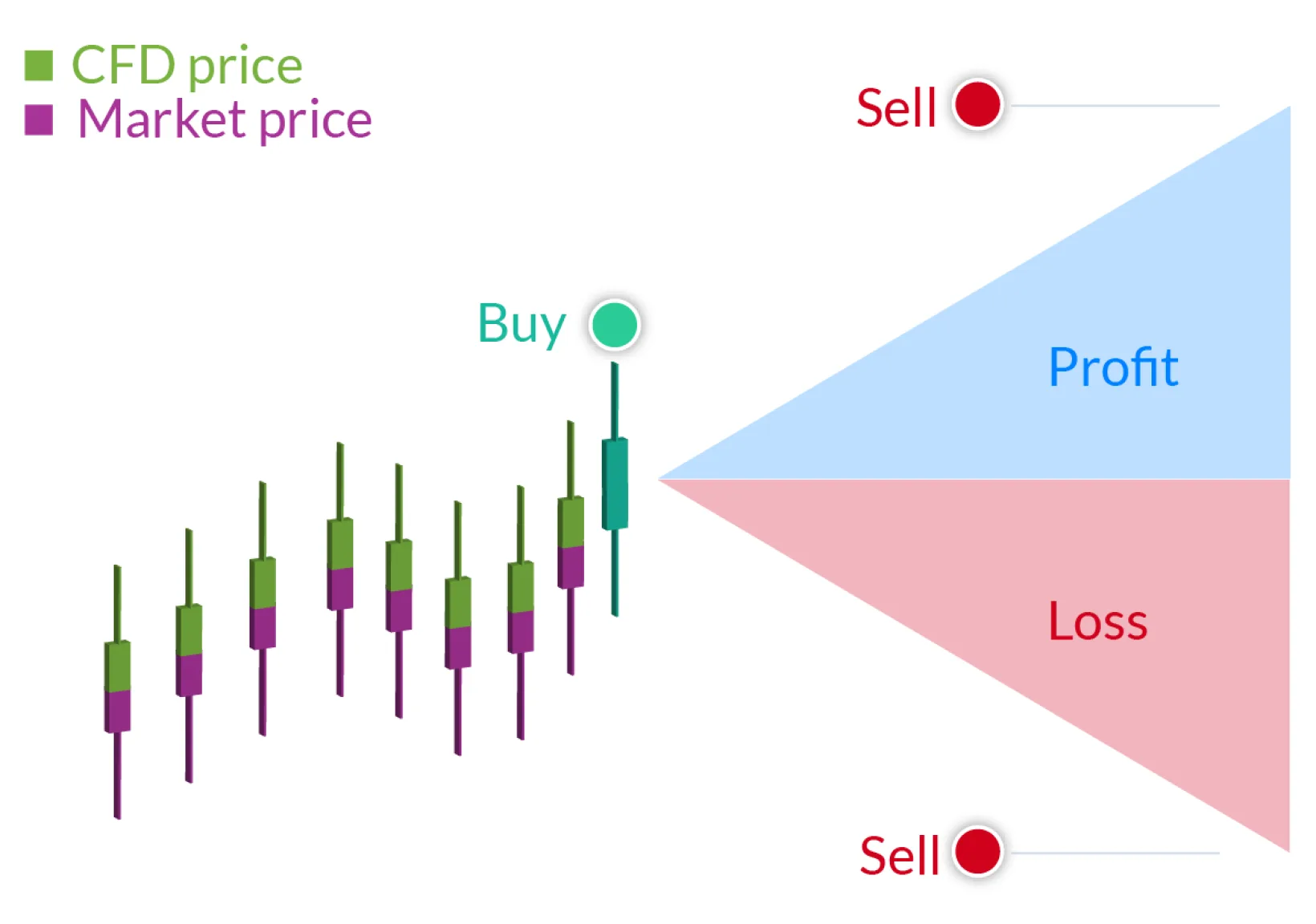

Contract for Difference (CFD) trading has gained significant traction in modern investment portfolios, offering investors opportunities for profit in various asset classes. However, it’s essential to understand the risks and rewards associated with CFDs to make informed investment decisions.

1. Potential for High Returns:

CFDs enable investors to capitalize on small price movements in a wide range of markets, providing the potential for high returns on investment. With the ability to trade on margin, investors can amplify their purchasing power, maximizing profit potential.

2. Risk of Losses:

While CFDs offer the potential for high returns, they also carry a significant risk of losses. Due to the leveraged nature of CFD trading, investors can incur substantial losses that exceed their initial investment. It’s crucial for investors to manage risk diligently and use risk management tools such as stop-loss orders.

3. Market Volatility:

CFD markets are inherently volatile, with prices subject to rapid fluctuations in response to various economic, political, and geopolitical factors. This volatility can result in sudden and significant price movements, leading to both opportunities and risks for traders.

4. Counterparty Risk:

When trading CFDs, investors are exposed to counterparty risk, as they are entering into agreements with the CFD provider. While reputable providers implement risk management measures, there’s always a risk of default or insolvency, which could potentially lead to loss of funds.

5. Regulatory Considerations:

CFD trading is subject to regulatory oversight in many jurisdictions, with regulations varying significantly between countries. Investors should be aware of the regulatory environment in their jurisdiction and choose reputable and regulated CFD providers to ensure the safety of their funds.

6. Psychological Impact:

The fast-paced nature of CFD trading, coupled with the potential for significant gains or losses, can have a psychological impact on investors. It’s essential for traders to maintain discipline, manage emotions, and stick to their trading plans to avoid making impulsive decisions.

In summary, while CFD trading offers investors opportunities for profit and portfolio diversification, it’s crucial to approach it with caution and awareness of the associated risks. By understanding the risks and rewards of CFD trading and implementing effective risk management strategies, investors can navigate the CFD market successfully.